Short Term Policies

BWP FAQ ?

What are the different risks covered under BP (ST)?

What are the different risks covered under BP (ST)?

Commercial risks:

[For BP-ST policies of the Buyer wise (commercial and political risks) Policy – short-term ] Insolvency of the buyer Failure of the buyer to make payment due within specified period ,normally within four months from due date of payment. Buyer’s failure to accept the goods (subject to certain conditions).

Political risks:

[For all BP-ST policies] Imposition of restrictions by the Government of the buyer’s country or any Government action which may block or delay the transfer of payment made by the buyer; War, civil war, revolution or civil disturbances in the buyer’s country; New import restrictions or cancellation of a valid import license; Interruption of voyage outside India resulting in payment of additional freight or insurance charges which cannot be recovered from the buyer;

Insolvency default of LC opening bank

[For BP-ST policies of the Buyer wise (insolvency & default of L/C opening bank and political risks) Policy – short-term.] Insolvency of the L/C opening bank; Failure of the LC opening bank to make the payment due within a specified period, normally four months from the due date;

Title: BWP FAQ

What are the risks not covered under BP (ST)?

What are the risks not covered under BP (ST)?

- Commercial disputes including quality disputes raised by the buyer, unless the exporter obtains a decree from a competent court of law in the buyer’s country in his favor;

- Causes inherent in the nature of goods;

- Buyer’s failure to obtain necessary import or exchange authorization from authorities in his country;

- Loss or damage to goods;

- Exchange rate fluctuation;

- Failure of the exporter to fulfill the terms of the export contract or negligence on his part.

- Persuading the buyer to make the payment while, at the same time, maintaining recourse against him by getting the bill noted and protested for non-payment;

- Not agreeing to give any extension of the due date of the bill unless there are good reasons for doing so. Prior approval of the Corporation should be taken for granting such extension. In case any condition is stipulated by the Corporation while granting extension, it should be ensured that the conditions are complied with;

- Where the documents/goods have not been accepted by the buyer, taking action to safeguard the goods and to resell them to an alternate buyer after giving due notice to the original buyer. Prior approval of the Corporation should be taken for resale, if the loss is likely to exceed 25% of the gross invoice value.

- If resale is not possible, bringing the goods back to India , with the prior approval of ECGC (if the loss is up to 25% of the gross invoice value such permission is not required).

- Desisting from making any further shipment to the buyer until he has made the payment for the bill in default.

- Commercial risks on both stock-holding agent and ultimate buyers with political risks for the entire period;

- Commercial risks on the ultimate buyers only with political risks for the entire period;

- Commercial risks on the stock-holding agent only with political risks for the entire period; and

- Only political risks for the entire period.

- The merchandise are shipped for stockholding to an overseas party who receives and holds the goods whether or not under written agreement;/li>

- The overseas party could be the exporter’s own branch office/ authorized representative/warehousing agent/associate or sister concern/subsidiary company;

- The overseas party’s responsibilities could, depending upon its legal status, be any or all of the following, viz., receiving the shipment, holding the goods in stock, identifying ultimate buyers and selling the goods to them in accordance with the directions, if any, of his principal (exporter); and

- The sales made by the overseas party need not necessarily be at the risk or on behalf of the exporter.

- Commercial risks on the ultimate buyers only with political risks for the entire period;/li>

- Only political risks for the entire period. However, in those cases where the intermediary is an associate of the exporter and both the exporter and the associate are joint stock companies with the exporter’s share in the capital of the associate not exceeding 49%, the following combinations of risks can also be covered:

- Insolvency of the global entity and commercial risks on ultimate buyers with political risks for the entire period.

- Insolvency of the global entity with political risks for the entire period.

- The contract would be for providing certain service during a defined period. It is not for completion of a particular work or job.

- Billing would be for the service rendered during a pre-determined interval – a week, a fortnight or a month. The contract should stipulate the documented mechanism for assessment of service rendered, periodicity of billing, documented mechanism of acceptance and due date for the payment of bills.

- Where there is a non-payment problem, there can be certain services invoiced and accepted but not paid, certain services invoiced but not accepted yet and certain services rendered but yet to be invoiced.

- There can be cases where there is no physical documentation. The entire process may be carried out through electronic media including billing. Consequently, there may not be any bank, which handles the documents.

- The contract could also provide for a system for detection of mistakes or errors while rendering the service and the procedure for correction. Penalties or reduction in payment for errors and omissions are also possible.

- Monthly declaration indicating the services rendered, invoices raised and invoices paid will have to be submitted by the exporters in the prescribed form. No separate overdue report will be necessary. In case of non-payment, the loss covered would be the invoices accepted but not paid, invoices raised but not yet accepted and services rendered but not invoiced (for one billing cycle only).

- The policyholder has to specify in advance the manner in which the work in progress would be estimated. (The reports could indicate the volume of work done and the rate to be applied on the defined unit to arrive at the work done. It could be a document giving the man hours spent and rate per man hour or it could be a simple number of days worked and rate per day).

- Liability of the Corporation would be for the services rendered and reported in the monthly declaration.

- The Corporation will have the right to examine the books of accounts and other documents of the exporter either on its own or through an authorized agency prior to admission of claim.

- The contract should provide for a clear acceptance mechanism in respect of services rendered and, if possible, a procedure for arbitration. It should also provide for a system for rectification of mistakes – errors and also omissions. The Corporation would not cover any loss due to errors or omissions.

- The policy would specify the loss limit up to which claim will be entertained due to any of the risks covered under the policy in respect of services rendered to the customer during the policy period.

- If the exporter desires enhancement of the customer loss limit and if the Corporation is satisfied with the reasons, the same may be agreed to with proportionate increase in the premium payable for the rest of the policy period from the month following the request for change subject to a minimum of three months.

- Similarly, the Corporation will have the discretion to reduce the loss limit on an insured customer with corresponding reduction in the premium amount payable for the rest of the policy period from the following month.

- The actual turnover in the prescribed format would be required at the time of renewal of the policy.

- The exporter is required to obtain the prior approval of the Corporation for extending the due date for any service rendered, if the revised due date is beyond 180 days from the date of rendering of such service.

- The non-receipt of payments is to be notified within 30 days from the due date or extended due date of payment.

- The claim is required to be filed in the prescribed form within one year from the due date of payment.

- On payment of claim, any recovery effected, shall be shared with the Corporation in the same proportion in which the loss was shared. However, the expensed incurred by the exporter for recovery with the prior approval of the Corporation shall be first charge on the amount recovered and the amount recovered net of recovery expenses shall be shared as explained.

- The exporter is required to submit the proposal form prescribed with the non-refundable policy fee of Rs.1,000/-.

- Commercial disputes including quality disputes raised by the b uyer, unless the exporter obtains a decree from a competent court of law in the buyer’s country in his favor.

- Causes inherent in the nature of the goods.

- Buyer’s failure to obtain necessary import or exchange authorization from authorities in his country.

- Insolvency or default of any agent of the exporter or of the collecting bank.

- Loss or damage to goods which can be covered by general insurers.

- Exchange rate fluctuation.

- Failure or negligence on the part of the exporter to fulfill the terms of the export contract.

- Rs.40 lacs for DP/CAD transactions on a particular buyer subject to the condition that claim will be limited to two buyers during a policy year.

- Rs.20 lacs on a particular buyer for DA/OD transactions in respect of exporters who have paid at Rs.5 lacs as premium in the immediately preceding policy year.

- Rs.30 lacs for DA/OD transactions and Rs.80 lacs for DP/CAD transactions subject to the condition that the aggregate credit limit on any single buyer under this sub-clause shall not exceed Rs.80 lac provided that,

- At least one shipment was effected by the exporter to the buyer during the preceding two year on similar payment terms and it was not less than the discretionary limit availed of by the exporter and

- The buyer had made payment for that shipment on the due date.

- The above discretionary limits applicable for DP/CAD transactions will be available for LC sight terms and the discretionary limits applicable for DA/OD transactions will be available for LC usage terms also..

- A small exporter may, without prior approval of ECGC convert a D/P bill into DA bill, provided that he has already obtained suitable credit limit on the buyer on D/A terms.

- Where the value of this bill is not more than Rs.3 lacs, conversion of D/P bill into D/A bill is permitted even if credit limit on the buyer has been obtained on D/P terms only, but only one claim can be considered during the policy period on account of losses arising from such conversions.

- A small exporter may, without the prior approval of ECGC extend the due date of payment of a D/A bill provided that a credit limit on the buyer on D/A terms is in force at the time of such extension.

- The exporter would be required to submit a progress report indicating the level of completion, payment sought and payment received and deviations in these areas.

- The exporter has to specify in advance the manner in which the work in progress would be estimated (namely, the reports that would be available on the volume of work done and the rate to be applied on the defined unit to arrive at the work done – it could be a document giving the man hours spent and rate per man hour or it could be a simple number of days worked and rate per day).

- Liability of the Corporation would be only for the work reported in the progress report.

- The Corporation will have the right to examine the books of accounts and other documents of the exporter either on its own or through an authorized agency prior to admission of claim. Certification by banks may be dispensed with in cases where it is felt that it is not possible.

- The contract should provide for a clear acceptance mechanism in respect of services rendered and, if possible, a procedure for arbitration. It should also provide for rectification of mistakes – errors and also omissions. The Corporation would not cover any loss due to errors or omissions.

- Loss coverage will be restricted to 80% as there is no salvage possibility.

- Apart from stipulating the loss limit on the buyer, the policy document would also specify the limit up to which the losses are covered under other risks.

- Default – the failure of the customer to pay to the exporter within four months after the due date of payment the contract price of services rendered to and accepted by the customer: or

- Insolvency of the customer: or

- Wrongful repudiation of the contract by the customer after the exporter has incurred expenses for commencement of services.

- The operation of a law or of an order, decree or regulation having the force of law, which, in circumstances outside the control of the Exporter and/or of the buyer prevents, restricts or controls the transfer of payment from the customer’s country to India: or

- The occurrence of war between the customers’ country and India: or

- The occurrence of war, hostilities, civil war, rebellion, revolution, insurrection or other disturbances in the customer’s country; or

- The imposition in India or in the customer’s country after the date of contract, of any law or of an order, decree or regulation having the force of law, which in circumstances outside the control of the Exporter and/ or the customer, prevents performance of the contract; or

- Any of the following causes of loss not being within the control of the exporter and/ or the customer which arises from an event occurring outside India;

- Refusal of visa for employees of exporter who are required to be in the place of the project to enable the exporter to execute contractual obligations for reasons not attributable to the exporter or customer.

- Increase in any tax or introduction of a new tax payable by the exporter in the customer’s country, which is not recoverable from the customer.

- Imposition by a competent court of law or the government, a rule or law or an order which results in losses / additional costs due to infringement of Intellectual Property Rights (IPR) of a process or software which was either in the domain of free software or the IPR was not established on the date of contract.

- Variation in exchange rates between Indian rupee and foreign currency concerned beyond three percentages over the stipulated level resulting in loss to the exporter for contracts involving service beyond 360 days.

- Insolvency of the buyer.

- Failure of the buyer to make the payment due within a specified period, normally four months from the due date.

- Buyer’s failure to accept the goods (subject to certain conditions).

- Imposition of restrictions by the Government of the buyer’s country or any Government action which may block or delay the transfer of payment made by the buyer;

- War, civil war, revolution or civil disturbances in the buyer’s country;

- New import restrictions or cancellation of a valid import license;

- Interruption of voyage outside India resulting in payment of additional freight or insurance charges which cannot be recovered from the buyer.

- Insolvency of the L/C opening bank;

- Failure of the LC opening bank to make the payment due within a specified period, normally four months, from the due date.

- Commercial disputes including quality disputes raised by the buyer, unless the exporter obtains a decree from a competent court of law in the buyer’s country in his favour;

- Causes inherent in the nature of goods;

- Buyer’s failure to obtain necessary import or exchange authorization from authorities in his country;

- Insolvency or default of any agent of the exporter or of the collecting bank;

- Loss or damage to goods;

- Exchange rate fluctuation;

- Failure of the exporter to fulfill the terms of the export contract or negligence on his part;

- Non-payment under a letter of credit due to any discrepancy pointed out by the L/C opening bank.

- Persuading the buyer to make the payment while, at the same time, maintaining recourse against him by getting the bill noted and protested for non-payment;

- Not agreeing to give any extension of the due date of the bill unless there are good reasons for doing so. Prior approval of the Corporation should be taken for granting such extension. In case any condition is stipulated by ECGC while granting extension, it should be ensured that the conditions are complied with;

- If the documents / goods have not been accepted by the buyer, taking action to safeguard the goods and to resell them to an alternate buyer after giving due notice to the original buyer. Prior approval of ECGC should be taken for resale, if the loss is likely to exceed 25% of the gross invoice value.

- If resale is not possible, to bring the goods back to India, with the prior approval of ECGC (if the loss is up to 25% of the gross invoice value such permission is not required).

- Desisting from making any further shipment to the buyer until he has made the payment for the bill in default.

- Failure of the contractor and/or the employer (where the employer is not a government) to obtain, issue or deliver any authority necessary under the law of India or the employer’s country for execution of the project and to make payment thereof;

- Risks which can normally be insured with commercial insurers;

- Insolvency, default or negligence of any agent, seller or sub-contractor;

- Execution of any works or incurring of any expenses by the Contractor after the employer has been in default in making any payment for a period of 120 days unless, on an application made by the contractor within 90 days of such default, ECGC has agreed to his continuing execution of the contract despite the employer’s default;

- Execution of any works or incurring of any expenses by the contractor after the estimated date for completion of the contract unless, at the request of the contractor, ECGC has agreed to a change in such date.

- Only such medium and long-term export projects which are viable and for which reinsurance is not available. Medium and long- term project exports involving civil constructions, turnkey projects, supply of equipments and services would come under these contracts.

- Exports to countries which are not likely to be covered on purely commercial considerations or are beyond country-exposure limits, acceptable credit terms/period prescribed by ECGC or countries currently facing economic/political difficulties, but where Indian presence is required to be maintained as a part of the long-term strategy of the Government of India.

- These transactions could be in the nature of a Buyer’s credit, Line of Credit, Supplier’s Credit, and those involving deferred terms of payments. This apart, transactions involving investments by Indian companies in overseas markets can be covered for the protection of their investments against expropriation risks and limited recourse covers (insolvency risks) against such joint venture entities in favour of banks when they seek funding from international banks.

- Receives, examines and processes proposals

- Submits proposals to COD for approval

- Issues credit covers on behalf of NEIA Trust

- Receives premium and credits them to NEIA Trust

- Receives, examines and settles claims as per decisions of COD

- Undertakes recovery action as per decisions of COD

- All expenses for recovery are debited to the Trust

- It is entitled to 5% of premium towards administrative expenditure

- Specific Shipment (Comprehensive Risks) Policy;

- Specific Shipments (Political Risks) Policy;

- Specific Contract (Comprehensive Risks) Policy; and

- Specific Contract (Political Risks) Policy.

Title: BWP FAQ

What is the procedure to be followed to obtain BP (ST)?

What is the procedure to be followed to obtain BP (ST)?

The exporter has to submit a proposal in the prescribed form. The proposal has to be submitted before making the shipments and the cover would be given only from the date of receipt of proposal. A buyer-wise/bank-wise limit based on the maximum expected outstanding indicated by the exporter will be fixed while issuing the policy.

Title: BWP FAQ

Can a BP (ST) policy be issued to cover exports to more than one buyer?

Can a BP (ST) policy be issued to cover exports to more than one buyer?

No. For every buyer, a separate policy has to be obtained.

Title: BWP FAQ

What is the period of validity of BP (ST)?

What is the period of validity of BP (ST)?

The policy would be valid for a period of one year.

Title: BWP FAQ

What is the percentage of cover provided by BP (ST)?

What is the percentage of cover provided by BP (ST)?

The percentage of cover normally available under the policy would be 80% of the gross value of the shipments covered. However, policy could also be issued with a lower percentage of cover with proportionate reduction in the amount of premium payable.

Title: BWP FAQ

What is the Maximum Liability of ECGC under BP (ST)?

What is the Maximum Liability of ECGC under BP (ST)?

The Maximum Liability (ML) is the limit up to which ECGC would accept liability under the policy.

Title: BWP FAQ

What is the credit assessment fee payable in respect of BP (ST)?

What is the credit assessment fee payable in respect of BP (ST)?

A credit assessment fee of Rs.1000/- shall be payable for proposals for buyer wise policy in respect of each buyer/bank. A credit enhancement fee of Rs.500/- is payable in case an enhancement in the limit subsequent to issue of the policy, is desired due to increased volume of business. In case of proposals for covering political risks only, no credit assessment fee will be charged.

Title: BWP FAQ

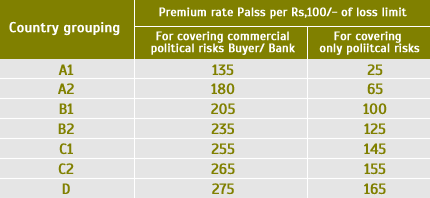

What are the applicable premium rates for BP (ST)?

What are the applicable premium rates for BP (ST)?

The rates of premium would be charged based on the terms of payment and the classification of the buyer’s or l/c opening bank’s country and premium rates would vary with the types of risk i.e . comprehensive or political , covered under the policy.

Title: BWP FAQ

Is any no claim bonus available for BP (ST)?

Is any no claim bonus available for BP (ST)?

Yes.

Title: BWP FAQ

How is the premium payable for BP (ST) determined and when is it required to be paid?

How is the premium payable for BP (ST) determined and when is it required to be paid?

Premium will be worked out on the projection given in the proposal in the proposal form and taking into account the applicable premium rates. The premium for the first quarter has to be paid within 15 days from the date the premium is called for. Premium for the subsequent quarters has to be remitted based on the projected turnover and also after adjusting any shortfall or excess in the premium paid for the earlier quarter, within 15 days from the beginning of the respective quarter.

Title: BWP FAQ

How is the adjustment of excess/short-paid premium to be carried out after the last quarter?

How is the adjustment of excess/short-paid premium to be carried out after the last quarter?

At the end of the last quarter, the actual turnover may vary with the projected. In such cases, if the exporter renews the policy for another term, the excess or shortage would be adjusted in the first quarter workings of the renewed policy.

Title: BWP FAQ

What are the circumstances in which the cover under BP (ST) can be withdrawn?

What are the circumstances in which the cover under BP (ST) can be withdrawn?

ECGC can withdraw the cover any time by informing the exporter in writing its intention to do so. The cover shall stand terminated from the date of such withdrawal. Shipments made to the buyer after that date will not stand covered under the buyer-wise policy.

Title: BWP FAQ

What are the obligations on the part of the exporter holding BP (ST)?

What are the obligations on the part of the exporter holding BP (ST)?

Submission of statement of shipments made:

Exporter has to submit, within 15 days after the end of the quarter, a statement of shipments made during the quarter in respect of the buyer/bank covered under the Buyer wise policy. It is also necessary to indicate in the statement the projected turnover for the next quarter in respect of the buyer/bank covered under the policy. Premium has to be paid along with the statement on the projected turnover for the quarter after adjusting any excess or short fall in the premium paid for the earlier quarter.

Submission of statement of overdue:

On or before 15th of every month is required to a statement of payments against the shipments under the contract which have remained overdue for more than thirty days from the due date;

Intimation of event affecting the risk:

If the exporter comes to know any event likely to affect the risk the same has to be intimated to ECGC and in any case by not later than 30 days;

Action for minimizing loss:

Immediate steps are to be taken in the event of non-payment for any shipment. On learning of non-payment for the shipment, for which the policy is obtained, exporter is required to take action to prevent/minimize the loss, including such action as may be intimated by ECGC. Action to prevent/minimise loss will depend on the facts and circumstances of each case. Given below is the course of action that may to be taken immediately:

Title: BWP FAQ

When is the loss under BP (ST) to be ascertained?

When is the loss under BP (ST) to be ascertained?

Normally loss shall be ascertained four months after the due date. In case of insolvency risk, loss shall be ascertained one month from the date of admission debt by the receiver or four months from the due date whichever is earlier. Where the debt is yet to be admitted by the receiver an undertaking from the exporter has to be obtained stating that he has done nothing or not omitted to anything that will make his claim in the insolvent estate in-admissible. Where the loss is due to non-acceptance of goods, loss shall be ascertained only the goods are resold or otherwise disposed of with the approval of ECGC and in any case not earlier than four months from the due date of payment.

Title: BWP FAQ

When can the exporter file a claim under BP (ST)?

When can the exporter file a claim under BP (ST)?

An exporter can file his claim under the policy any time after the loss is ascertained but within one year from the due date of payment for the shipment claim.

Title: BWP FAQ

What action has the exporter to take for recovery on payment of claim under BP (ST)?

What action has the exporter to take for recovery on payment of claim under BP (ST)?

Upon payment of a claim the exporter shall continue to take steps for recovering dues from the buyer including action, if any, stipulated by the Corporation. Any amount spent on recovering the dues shall have a first charge on recovery. The amount recovered net of recovery expenses shall be shared between ECGC and the exporter in the same ratio in which the loss is shared.

To download the proposal form for Buyerwise Policy (Short term), click here.

For any further clarification, click here.

For any further information on the product, please contact the branch managers of local ECGC Offices .

Title: BWP FAQ

Consignment Exports Policy FAQ ?

In the aforesaid situation, what are the various combination of risks that can be covered under the policy?

In the aforesaid situation, what are the various combination of risks that can be covered under the policy?

The various combination of risks that can be covered under the consignment Exports (Stock-holding Agent) Policy at the option of the exporters are:

Title: Consignment Exports Policy FAQ

Under what circumstances Consignment Exports (Global Entity) Policy cover can be availed of?

Under what circumstances Consignment Exports (Global Entity) Policy cover can be availed of?

A Consignment Exports (Global Entity) Policy can be availed for each exporter-global entity combination provided the following criteria are satisfied:

Title: Consignment Exports Policy FAQ

What the combination of risks which can be covered under Consignment Exports (Global Entity) Policy?

What the combination of risks which can be covered under Consignment Exports (Global Entity) Policy?

The combinations of risks which can be covered under the Consignment Exports (Global Entity) Policy are:

Title: Consignment Exports Policy FAQ

What are the premium rates applicable for a Consignment Exports Policy?

What are the premium rates applicable for a Consignment Exports Policy?

For premium rates applicable for both types of policy, please click here. Separate rates are given for covering different sets of risks.. The premium rate applicable in each case will be as per the classification of the country of the intermediary provided sales to all the ultimate buyers are to be effected in the same country or countries of same or better classification. But if some of the ultimate sales take place in countries of riskier classification, the premium rate will be quoted taking into account the proportion of projected sales in different country groups.

Title: Consignment Exports Policy FAQ

What is the procedure for payment of premium and submission of shipment declaration?

What is the procedure for payment of premium and submission of shipment declaration?

Payment of premium determined would be by way of advance deposit premium on a quarterly or monthly basis (as opted by the exporter) worked out on the basis of projected turnover and to be appropriated subsequently on the basis of actual reported. The premium for the first quarter (or month) has to be paid within 15 days from the date the premium is called for. Premium for the subsequent quarters (months) has to be remitted based on the projected turnover and also after adjusting any shortfall or excess in the premium paid for the earlier quarter (month), within 15 days from the beginning of the respective quarter (month). During every quarter (month) the exporter has to ensure that sufficient premium is available to cover the shipments being made. When the actual shipments are likely to exceed the projection, the exporter has to deposit sufficient amount forthwith in his premium account with the Corporation to cover the shipments. Irrespective of the periodicity opted for by the exporter to pay the premium; the policyholders are required to submit shipment declarations monthly in the prescribed format.

Title: Consignment Exports Policy FAQ

How credit limits and discretionary credit limits will be fixed under Consignment Exports Policy?

How credit limits and discretionary credit limits will be fixed under Consignment Exports Policy?

Credit limit on the stock-holding agent would be fixed at the time of issue of Consignment Exports (Stock-holding Agent) Policy. For covering commercial risks on the ultimate buyers in respect of both types of policies, the exporter will have the benefit of discretionary limits on all of them up to a predetermined limit; for requirements beyond this limit, the exporter will have to get a credit limit approved by the Corporation. Discretionary limit would be fixed at the time of issue of the Policy. Such a limit to be fixed separately in each case will be below 5% of the projected annual sales through the stock-holding agent/global entity subject to a minimum of Rs.10 lacs and a maximum of Rs.100 lacs. Discretionary limits would be applicable only for ultimate buyers in open cover countries and not in restricted cover countries (groups I and II). Discretionary limit will not be available in respect of buyers who have come to the adverse notice of ECGC. This information is available on the website of the Corporation and can be therefore obtained by the policyholder by accessing the website.

Title: Consignment Exports Policy FAQ

What is the percentage of cover provided under Consignment Exports Policy?

What is the percentage of cover provided under Consignment Exports Policy?

The percentage of loss covered would generally be at 90 percent for those who hold the Corporation’s SCR Policy/Exports (Turnover) Policy and at 80 percent for others.

Title: Consignment Exports Policy FAQ

What is the time limit for realization of export proceeds?

What is the time limit for realization of export proceeds?

The basic premium rates are applicable if the payment for the shipment effected from India is received within 360 days of the date of shipment and are independent of the credit periods allowed to the agent/intermediary and/or the ultimate buyers. Premium at these rates becomes payable in advance on monthly or quarterly basis before shipments are made. For the purpose of deciding whether payment for a particular shipment is received in India within 360 days or not, the principle ‘first in first out’ (FIFO) will be followed.

Title: Consignment Exports Policy FAQ

When can the exporter file claim under Consignment Export Policy?

When can the exporter file claim under Consignment Export Policy?

Claims against losses arising out of any risks covered by the policies will have to be filed within a period of two years from the due date (or extended due date) for realization of the sale proceeds in India. Unit price mentioned in the invoice raised by the exporter to the intermediary (stock-holding agent or global entity) shall be taken into account while processing claim, if any for determining the loss. If unit price was reduced in the international market due to market fluctuations, the reduced price will be taken into account. However, if the international price has increased, the Corporation’s liability will be restricted to the value worked out on the basis of the unit price mentioned in the invoice or the declared value whichever is less.

To download the proposal form for Consignment Exports Policy,click here.

For any further clarification,click here.

For any further information on the product, please contact the branch managers of localECGC Offices .

Title: Consignment Exports Policy FAQ

ETP FAQ ?

In what respect is the procedure for submission of shipping declarations simplified in case of holders of turnover policy?

In what respect is the procedure for submission of shipping declarations simplified in case of holders of turnover policy?

The holders of turnover policy need not submit monthly declarations of shipment. Instead, they have only to submit a statement of shipments made during the quarter in a prescribed format within 30 days of the end of the quarter. However, option for submitting shipment declaration on monthly is also available under this policy

Title: ETP FAQ

What are the premium rates and discount rates applicable to the turnover policy?

What are the premium rates and discount rates applicable to the turnover policy?

The basic premium rates applicable for the standard policy will apply to the turnover policy also. However, an exporter holding a standard policy opts for turnover policy, he will be entitled to an additional discount of 10% over and above the ‘no claim bonus’ which he is enjoying under the standard policy, subject to a minimum total discount of 20%. If an exporter not holding the standard policy avails of the turnover policy, he will be entitled to a discount of 20%.

Title: ETP FAQ

What is the procedure for payment of premium under the turnover policy?

What is the procedure for payment of premium under the turnover policy?

The premium calculated on the projected turnover is payable in four quarterly installments (grant of facility of payment of premium in monthly installments will be considered on a case to case basis). The premium installment has to be paid in advance on the basis anticipated exports turn over , before the commencement of shipments in any month or quarter under applicable mode of premium installment.

Title: ETP FAQ

How is the difference between premium paid on projected turnover and premium payable on actual turnover settled?

How is the difference between premium paid on projected turnover and premium payable on actual turnover settled?

At the end of the year, if the premium payable on the basis of the actual turnover is less than the premium paid on the basis of the projected turnover, the excess amount paid will be carried forward to the next policy period and could be adjusted in the premium for the first quarter of the renewed policy

Title: ETP FAQ

To download the proposal form for Export Turnover Policy ,click here.

For any further clarification,click here.

For any further information on the product, please contact the branch managers of localECGC Offices

Title: ETP FAQ

ITES FAQ ?

What are the important features of IT- enabled services contract that will be eligible for cover under IT-enabled services policy?

What are the important features of IT- enabled services contract that will be eligible for cover under IT-enabled services policy?

Some of the important features of the IT enabled services contracts are as follows:

Title: ITES FAQ

What are the important features of the IT-enabled services policy?

What are the important features of the IT-enabled services policy?

Some of the important features of these policies would be as follows:

Title: ITES FAQ

What are the applicable premium rates under ITES (specific customer) Policy?

What are the applicable premium rates under ITES (specific customer) Policy?

The premium rates for covering all services rendered in a policy year under the ITES (specific customer) policy are given below.

Title: ITES FAQ

What is the procedure for payment of premium under ITES (specific customer) Policy?

What is the procedure for payment of premium under ITES (specific customer) Policy?

Exporters opting for this Policy would be offered the option to remit the premium either on a quarterly installment basis or on an annual basis. Where the exporter opts to pay premium on an annual basis, a discount of 5% would be given in the premium payable. Premium for every quarter shall be payable in advance prior to the beginning of the quarter. In case of any delay, the cover shall not be available in respect of shipments made during the period from the beginning of the quarter up to the date of remittance. Where the premium amount is paid on a quarterly installment basis, should a claim arise prior to the remittance of some of the installments, the entire amount shall become payable before the claim is filed by the exporter. Premium once paid is treated as non-refundable. In case the Corporation withdraws cover during the period of the policy due to any reason, the proportionate premium for the balance period in months beyond the month in which the cover is withdrawn will be refunded subject to retention of minimum premium equivalent to 25% of the total premium.

Title: ITES FAQ

What are the other procedural requirements under the ITES (specific customer) Policy?

What are the other procedural requirements under the ITES (specific customer) Policy?

To download the proposal form for ITES (specific customer) Policy, click here.

For any further clarification,click here.

For any further information on the product, please contact the branch managers of localECGC Offices .

Title: ITES FAQ

MBEP Faq ?

What will be duration of policy and percentage of cover ?

What will be duration of policy and percentage of cover ?

One year and 80%

Title: MBEP Faq

What is maximum Liability under this policy ?

What is maximum Liability under this policy ?

The maximum liability will be denoted by Aggregate Loss Limit (ALL ) under the policy . ALL is the value of the limit up to which the Corporation shall cover exposure in respect of all buyers covered during the policy period. ALL sought should not be less 10% of the annual export turnover applicable for the categories/countries under the cover of the policy.

Title: MBEP Faq

What is the extent of cover available on the individual buyer/bank under policy?

What is the extent of cover available on the individual buyer/bank under policy?

The buyer on whom the policy is issued , the cover will be available up to a loss limit which is restricted 10% of ALL of the policy.

Title: MBEP Faq

How will the Aggregate Loss Limit be enhanced under the policy ?

How will the Aggregate Loss Limit be enhanced under the policy ?

If you wish to get the Aggregate Loss Limit (ALL) enhanced, apply for enhancement in the prescribed format before making shipments by remitting the required additional premium.

Title: MBEP Faq

How cover will be available on any buyer in excess of 10% of the Aggregate Loss Limit?

How cover will be available on any buyer in excess of 10% of the Aggregate Loss Limit?

If the total outstanding on any buyer is likely to exceed 10% of the (ALL), you may obtain Single Buyer Exposure Policy on the buyer.

Title: MBEP Faq

Which buyers or l/c opening banks would be covered under the policy?

Which buyers or l/c opening banks would be covered under the policy?

Before making shipment, it is to be ensured that the buyer is not placed in the list of buyers on whom adverse notice is received , maintained by the Corporation . The buyers can be checked by accessing the website of the Corporation.The cover is available for banks with the world rank up to 25000 as per the latest Banker’s Almanac.

Title: MBEP Faq

Will the cover be available for buyers in all countries ?

Will the cover be available for buyers in all countries ?

The cover under the policies would be available for exports made to the buyers or against L/cs opened by banks in Open cover countries as per Country category list of the Corporation . The exports to the countries in the Restricted Categories List of the Corporation are not cover under this policy. Before making shipment information on country category should be obtained by accessing website of the Corporation.

Title: MBEP Faq

When the premium for the policy will be paid ?

When the premium for the policy will be paid ?

The premium under policy is payable fully in advance. However, there is a facility for paying the premium in four quarterly installments. It is to be ensured that each quarterly Premium installment is remitted on or before 15th of the beginning of the quarter (applicable if installment facility is opted for).

What steps are to be taken when an export bill becomes overdue ?

What steps are to be taken when an export bill becomes overdue ?

a. A declaration is to be submitted on or before 15th of every month regarding all bills which remained unpaid for more than 30 days from due date as at the end of previous month .

b. Reason for non acceptance / non payment should be ascertained. The safe custody of the goods in a bonded warehouse should be arranged in the event of non acceptance of goods by the buyer.

c. If the terms of payment is DA/OD and nonpayment is due to insolvency of the buyer, a claim should be lodged with the Official Receiver to rank against the insolvent’s estate.

d. The unpaid bill should be noted and protested by a notary public in the buyer’s country for non acceptance / nonpayment by the buyer with the assistance of your bank.

e. Prompt and effective steps for recovery of the debt should be taken. Names of the debt recovery agencies, Indian Embassies and Solicitors can be obtained from ECGC.

f. All other practicable steps to minimize including resale to an alternate buyer or reshipment back to India in respect of goods unaccepted by the buyer, as per advice of the Corporation.

Title: MBEP Faq

What is the time limit for filing the claim?

What is the time limit for filing the claim?

File the claim on the prescribed form with all enclosures listed therein within 12 months from the due date of the unpaid bill.

To download the Proposal for Buyer Exposure(Multiple Buyer) Policy,click here.

For any further clarification, click here.

For any further information on the product, please contact the branch managers of locaECGC Offices.

Title: MBEP Faq

SBEP FAQ ?

Read more about Specific Buyer Exposure Policy FAQ PDF Read more about Specific Buyer Exposure Policy What will be duration of policy and percentage of cover ?

What will be duration of policy and percentage of cover ?

One year and 80% . Exporter holding ETP/ SCR policy can have cover up to 90%

Title: SBEP FAQ

What is the extent of cover available on the individual buyer/bank under policy?

What is the extent of cover available on the individual buyer/bank under policy?

The buyer on whom the policy is issued , the cover will be available up to a loss limit which is fixed on the basis credit worthiness assessment made on the buyer by the Corporation. The buyers in the restricted cover categories(RCCs) as per the country list maintained by the Corporation will be not be covered under this policy.

Title: SBEP FAQ

Whether cover will be available for l/c opening banks under the policy?

Whether cover will be available for l/c opening banks under the policy?

The cover is available for banks with the world rank up to 25000 as per the latest Banker’s Almanac

Title: SBEP FAQ

When the premium for the policy will be paid ?

When the premium for the policy will be paid ?

The premium under policy is payable fully in advance. However, there is a facility for paying the premium in four quarterly installments. It is to be ensured that each quarterly Premium installment is remitted on or before 15th of the beginning of the quarter (applicable if installment facility is opted for). Where the premium is paid on a quarterly installment basis, should a claim arise prior to some installments, the entire amount shall become payable before the claim is filed.

Title: SBEP FAQ

What steps are to be taken when an export bill becomes overdue ?

What steps are to be taken when an export bill becomes overdue ?

a. A declaration is to be submitted on or before 15th of every month regarding all bills which remained unpaid for more than 30 days from due date as at the end of previous month .

b. Reason for non acceptance / non payment should be ascertained. . The safe custody of the goods in a bonded warehouse should be arranged in the event of non acceptance of goods by the buyer.

c. Further shipments to buyer should not be made without prior consent of the Corporation.

d. If the terms of payment is DA/OD and nonpayment is due to insolvency of the buyer, a claim should be lodged with the Official Receiver to rank against the insolvent’s estate.

e. The unpaid bill should be noted and protested by a notary public in the buyer’s country for non acceptance / nonpayment by the buyer with the assistance of your bank.

f. Prompt and effective steps for recovery of the debt should be taken. Names of the debt recovery agencies, Indian Embassies and Solicitors can be obtained from ECGC.

g. All other practicable steps to minimize including resale to an alternate buyer or reshipment back to India in respect of goods unaccepted by the buyer, as per advice of the Corporation.

Title: SBEP FAQ

What is the time limit for filing the claim?

What is the time limit for filing the claim?

File the claim on the prescribed form with all enclosures listed therein within 12 months from the due date of the unpaid bill.

Download the proposal form PDF for Buyer Exposure (Single Buyer) PolicyTo download the Proposal for Buyer Exposure(Single Buyer) Policyclick here.

For any further clarification,click here.

For any further information on the product, please contact the branch managers of local ECGC Offices.

Title: SBEP FAQ

SCR FAQ ?

What are the risks not covered under the Standard Policy?

What are the risks not covered under the Standard Policy?

The policy does not cover losses due to the following risks:

Title: SCR FAQ

Which all shipments made by the exporter are required to be covered under the Standard Policy?

Which all shipments made by the exporter are required to be covered under the Standard Policy?

The Standard Policy is meant to cover all the shipments made by an exporter, on credit terms during the period of 24 months after the issue of the policy. In other words, an exporter is required to offer for the cover of the policy each and every shipment that may be made by him in the next 24 months on all terms of payments such as DP, DA or OD terms to all buyers other than his own associates.

Title: SCR FAQ

Are there any shipments excluded from the purview of the Standard Policy?

Are there any shipments excluded from the purview of the Standard Policy?

An exporter may exclude , which are supported by irrevocable Letters of Credit, which carry the confirmation of banks in India, since he faces no risk in respect of such transactions. Exporters of the status of trading houses and above are allowed to exclude shipments of specified commodities or shipments to buyers in specified countries or any combination of these two, from the purview of the Standard Policies held by them.

Title: SCR FAQ

Are L/C shipments required to be covered by the Standard Policy?

Are L/C shipments required to be covered by the Standard Policy?

Exporters holding Standard Policy may opt to get shipments against irrevocable Letter of Credit excluded from the scope of the policy. However, unless they are confirmed by banks in India, payment under irrevocable Letters of Credit is subject to political risks. Exporters are, therefore, well advised to get such shipments also covered under the policy. For such shipments, an exporter has option to obtain cover for either political risks only or for comprehensive risks, i.e., for all political risks and the risk of insolvency or default of the bank opening the irrevocable Letter of Credit. The comprehensive risk cover also provides indemnity to the exporter to the extent of 25% of the gross invoice value if the LC opening bank refuses payment on the ground of discrepancies in LC, which are not clearly attributable to the exporter. In either case, cover will be provided by ECGC only if the exporter agrees to get all the shipments made against irrevocable Letter of Credit covered under the policy. Cover will not be available for selected transactions.

Title: SCR FAQ

Are shipments made to exporter’s associates covered by the Standard Policy?

Are shipments made to exporter’s associates covered by the Standard Policy?

Shipments to foreign buyers who are associates of the exporters, i.e. in whose business the exporter has a financial interest, are normally excluded from the policy. They can, however be, covered against political risks under the policy if an exporter so desires. Where both the exporter and the associate are public limited companies and where the exporter’s share holding in the associate does not exceed 49%, cover can be provided against insolvency risks in addition to the political risks.

Title: SCR FAQ

Is there any difficulty in covering air shipments under the Standard Policy?

Is there any difficulty in covering air shipments under the Standard Policy?

When shipments are made by air, the buyers are often able to obtain delivery of the goods from the airlines before making payment of the bills or accepting them for payment, as the case may be. Earlier such shipments could be covered only if the exporter was holding appropriate credit limit on open delivery (OD) terms and had paid premium at the higher rates applicable for OD. ECGC has now decided that credit limits sanctioned under DA will be valid for OD also. Hence, the premium rate for DA applied for OD also. As a result, shipments by air can be covered by the Standard Policy if the exporter holds a valid credit limit under DA and pays premium at the rates applicable for the relevant credit period under DA.

Title: SCR FAQ

Can pre-shipment risks be covered under the Standard Policy?

Can pre-shipment risks be covered under the Standard Policy?

The Standard Policy provides cover only for the post-shipment risks. Pre-shipment losses, i.e. losses which may be sustained by an exporter due to impossibility of exporting goods already manufactured or purchased for reasons like ban on export of the item, restrictions on import of the items into the buyer’s country, war, civil war, cancellation of contract by the overseas buyer etc., are not covered under the policy.

Title: SCR FAQ

Can shipments made on credit exceeding 180 days be covered?

Can shipments made on credit exceeding 180 days be covered?

The policy is meant to provide cover for shipments involving a credit period not exceeding 180 days. In exceptional cases, however, cover may be granted for shipments with longer credit period, provided that such longer credit periods are justifiable for the export items concerned.

Title: SCR FAQ

Is there any ceiling to ECGC’s liability under the Standard Policy?

Is there any ceiling to ECGC’s liability under the Standard Policy?

Yes. ECGC will fix a Maximum Liability under each Standard Policy, which is intended to cover all the shipments during a period of 24 months from the date of issue of the Policy. The Maximum Liability is the limit up to, which ECGC would accept liability for shipments made in each of the policy-years, for both commercial and political risks. The exporters are advised to estimate the maximum outstanding payments due from overseas buyers at any one time during the policy period and to obtain the policy with Maximum Liability for such a value. The Maximum Liability fixed under the policy can be enhanced subsequently, if necessary.

Title: SCR FAQ

After obtaining a Standard Policy with a suitable Maximum Liability, what else should the exporter do to ensure that his shipments are insured?

After obtaining a Standard Policy with a suitable Maximum Liability, what else should the exporter do to ensure that his shipments are insured?

The exporter has to get a credit limit approved from ECGC in respect of each foreign buyer to whom he would like to make shipments on DP/DA/OD terms of payment. In addition, if shipments are made to a buyer in some of the countries classified by ECGC as restricted cover countries (see below for details), Specific Approval of ECGC should be obtained for such shipment. Further, the exporter has to declare to ECGC all his shipments and pay premium as explained later.

Title: SCR FAQ

What is the purpose of credit limit and what should the exporter do to get it sanctioned?

What is the purpose of credit limit and what should the exporter do to get it sanctioned?

Commercial risks are covered under the policy only if a credit limit is approved by ECGC on each buyer to whom shipments are made on credit terms. The exporter has, therefore, to apply for a suitable credit limit on each buyer. On the basis of its own judgment of the creditworthiness of the buyer, as ascertained from credit reports obtained from banks and specialized agencies abroad, ECGC will approve the credit limit which is the limit up to which it will pay claim on account of losses arising from commercial risks on account of that buyer. The credit limit is a revolving limit and once approved, it will hold good for all shipments to the buyer as long as there is no gap of more than 12 months between two shipments. Credit limit is a limit on ECGC’s exposure on the buyer for commercial risks and not a limit on the value of shipments that may be made to him. In case of losses due to political risks, ECGC’s exposure is not restricted by the credit limit. Premium has, therefore, to be paid on the full value of each shipment even where the value of the shipment or the total value of the bills outstanding for payment is in excess of the credit limit.As the credit limit is indicative of the safe limit of credit that can be extended to the buyer, the exporters are advised to see that the total value of the bills outstanding with the buyer at any one time is not out of proportion to the credit limit. In cases where the credit limit that ECGC is prepared to grant is far lower than the value of outstanding bills, exporters may discuss the problem with ECGC officials.

Title: SCR FAQ

What are the charges to be paid for getting credit limit sanctioned?

What are the charges to be paid for getting credit limit sanctioned?

ECGC spends a considerable amount of money for obtaining reports on overseas buyers from banks and credit information agencies abroad in order to assess their credit standing and approves credit limits based on such assessment. ECGC charges a status enquiry fee of Rs.500 for each credit limit application.

Title: SCR FAQ

Can any shipment be made without obtaining credit limits?

Can any shipment be made without obtaining credit limits?

Yes, in the following cases the shipments will be covered under the policy even if he has not applied for credit limits; in other words the exporter can avail of discretionary credit limits.

Title: SCR FAQ

What are restricted cover countries? Is any special procedure applicable for exports to them?

What are restricted cover countries? Is any special procedure applicable for exports to them?

For a large majority of countries, the Corporation places no limit for covering political risks. Such countries are referred to as ‘open cover’ countries. s. However, in the case of certain countries where the political risks are very high, cover is granted on a restricted basis. In respect of some of such countries, revolving limits normally valid for one year are issued in place of credit limits. The procedure for sanction of revolving limits is the same as for credit limits. In respect of the few remaining countries under restricted cover, which are considered as high risk countries, specific approvals are given on the merits of each case. Normally the period of validity of the specific approval is six months.

Title: SCR FAQ

What is the percentage of cover provided by ECGC?

What is the percentage of cover provided by ECGC?

ECGC normally pays 90% of the loss, whether it arises due to commercial risks or political risks. The remaining 10% has to be borne by the exporter himself. However, ECGC reserves the right to offer a lower percentage of cover in certain cases.

Title: SCR FAQ

What is the premium an exporter has to pay for a Standard Policy?

What is the premium an exporter has to pay for a Standard Policy?

Premium payable will be determined on the basis of projected exports on an annual basis subject to a minimum premium of Rs. 10,000 for the policy period. Premium shall be payable in advance against all shipments covered under the policy based on projected shipments value on a monthly basis .

Title: SCR FAQ

What is the time limit for declaration of shipments?

What is the time limit for declaration of shipments?

On or before the 15th of every month the policyholder is required to declare to ECGC in a prescribed form, all the shipments made by him in the preceding calendar month. If no shipment is made in a month, a NIL declaration should be sent.

Title: SCR FAQ

What are the applicable premium rates?

What are the applicable premium rates?

The rates of premium vary depending upon the terms of payment, the classification of the buyer’s country and whether a shipment is covered against comprehensive risks or only political risk. Premium at the rates applicable for political risks is payable on shipments to Associates and shipments made against irrevocable Letters of Credit, where the exporter has opted to cover such shipments. To find out the premium payable, please contact your nearest ECGC Branch. To locate your nearest ECGC Branch, please click here.

Title: SCR FAQ

Is any reduction allowed in the premium rates?

Is any reduction allowed in the premium rates?

If no claim is made on ECGC during a policy period of one year, a no-claim bonus of 5% is granted in the premium rates at the time of renewal of the policy. No claim bonus can be accumulated for every policy period till a maximum bonus of 50% is reached.

Title: SCR FAQ

Is the exporter liable to pay premium if the credit limit asked for on a buyer is either refused or not sanctioned to the full extent?

Is the exporter liable to pay premium if the credit limit asked for on a buyer is either refused or not sanctioned to the full extent?

In respect of shipments to buyers on whom ECGC has refused credit limits, the exporter will have the option of either paying premium for only political risks or not paying any premium at all. If the full amount of credit limit asked for by an exporter on a buyer is not sanctioned by ECGC, the exporter will have the option of paying comprehensive premium on all shipments to the buyer (with the cover for commercial risks restricted to the credit limit sanctioned, but cover for political risk to the full extent) or paying premium for political risks only on all shipments or not paying any premium for the shipments to that buyer under the Standard Policy after surrendering the original approved credit limit on the buyer.

Title: SCR FAQ

Should non-payment of the bill by the due date be reported to ECGC?

Should non-payment of the bill by the due date be reported to ECGC?

Yes. In the event of non-payment of any bill by the foreign buyer by the due date, the policyholder is required to take prompt and effective steps to prevent or minimize loss. A monthly declaration of all bills which remain unpaid for more than 30 days should be submitted to ECGC in the prescribed form indicating action taken in each case. Prior approval of ECGC is required for granting extension of time for payment, converting bill from DP to DA terms or resale of unaccepted goods at a lower price (if the loss exceeds a certain limit).

Title: SCR FAQ

Is approval of ECGC required for extending credit period or changing the tenor of the bills?

Is approval of ECGC required for extending credit period or changing the tenor of the bills?

Yes. It may sometimes become necessary for an exporter to extend the credit period of a DA bill or to convert a DP bill into a DA bill in circumstances in which the buyer is unable to meet the payment obligation as per the original tenor of the bill. Whenever a policyholder wishes to grant such extensions or conversions for good reasons, he should get the prior approval of ECGC and pay the necessary additional premium.

Title: SCR FAQ

Should ECGC approval be taken for resale of unaccepted goods?

Should ECGC approval be taken for resale of unaccepted goods?

Not always. The policyholder is obliged to take immediate and effective action to minimize the possible loss if and when a buyer does not take delivery of the goods. If he wishes to resell the goods to an alternate buyer or bring back the goods to India, approval of ECGC is to be obtained only if the loss on account of resale or reshipment exceeds 25% of the gross invoice value. Notice of resale should be given to the original buyer so that it would be possible to take legal action against him subsequently, if considered necessary, for recovery of the loss.

Title: SCR FAQ

When does an exporter become eligible for receiving payment of a claim under the Policy?

When does an exporter become eligible for receiving payment of a claim under the Policy?

A claim will arise when any of the risks insured under the policy materializes. If any overseas buyer goes insolvent, the exporter becomes eligible for a claim one month after his loss is admitted to rank against the insolvent’s estate or after four months from the due date, whichever is earlier. In case of protracted default the claim is payable after four months from the due date. Claims in respect of additional handling, transport or insurance charges incurred by the exporter because of interruption or diversion of voyage outside India are payable after proof of loss is furnished. In all other cases claim is payable after four months from the date of the event causing loss.However, in case of exports to countries where long transfer delays are experienced, ECGC may extend the waiting period and claims for such shipments are payable after the expiry of such extended period.Where the buyer does not accept goods or pay for them because of disputes over fulfillment of the terms of contract by the exporter, counter claims or set-off, ECGC considers the claim after the dispute between the parties is resolved and the amount payable is established, by obtaining a decree in a court of law in the country of the buyer.

Title: SCR FAQ

Who is responsible to recover the debts from the foreign buyer after the claim is paid by ECGC?

Who is responsible to recover the debts from the foreign buyer after the claim is paid by ECGC?

Payment of claims by the ECGC does not relieve an exporter of his responsibility for taking recovery action and realizing whatever amount can be recovered. The exporter should, therefore, consult ECGC and take prompt and effective steps for recovery of the debts. For its part, ECGC will help the exporter by providing the name of a reliable lawyer and/or debt collecting agency and by enlisting the help of India’s commercial representative in the buyer’s country. It is also to be noted that receipt of a claim from ECGC does not relieve an exporter from obligations to the Exchange Control Authority for recovering the amount from the overseas buyers.

Title: SCR FAQ

How is the amount recovered from foreign buyer shared?

How is the amount recovered from foreign buyer shared?

All amounts recovered, net of recovery expenses should be shared with ECGC in the ratio in which the loss was originally shared.

Title: SCR FAQ

How to obtain a Policy?

How to obtain a Policy?

The exporter should fill in a Proposal Form, which can be downloaded from here or obtained from any of the ECGC offices and send it to the nearest ECGC office. He should also confirm his acceptance of the premium rates, a schedule of which will be given to him along with the Proposal Form and remit applicable premium.

To download the proposal form for SCR or Standard Policy,click here.

For any further clarification,click here.

For any further information on the product, please contact the branch managers of localclick here.

Title: SCR FAQ

SEC FAQ ?

In what respects is the Small Exporter’s Policy different from the Standard Policy?

In what respects is the Small Exporter’s Policy different from the Standard Policy?

Period of Policy:

Small Exporter’s Policy is issued for a period of 12 months, as against 24 months in the case of Standard Policy.

Minimum premium:

Premium payable will be determined on the basis of projected exports on an annual basis subject to a minimum premium of Rs. 2000/- for the policy period. No claim bonus in the premium rate is granted every year at the rate of 5% (as against once in two years for Standard Policy at the rate of 10%).

Declaration of shipments:

Shipments need to be declared quarterly (instead of monthly as in the case of Standard Policy).

Declaration of overdue payments:

Small exporters are required to submit monthly declarations of all payments remaining overdue by more than 60 days from the due date, as against 30 days in the case of exporters holding the Standard Policy.

Percentage of cover:

For shipments covered under the Small Exporter’s Policy ECGC will pay claims to the extent of 95% where the loss is due to commercial risks and 100% if the loss is caused by any of the political risks (Under the Standard Policy, the extent of cover is 90% for both commercial and political risks).

Waiting period for claims:

The normal waiting period of 4 months under the Standard Policy has been halved in the case of claims arising under the Small Exporter’s Policy.

Change in terms of payment of extension in credit period:

In order to enable small exporters to deal with their buyers in a flexible manner, the following facilities are allowed:

To download the proposal form for Small Exporters Policy (Short term),click here.

For any further clarification,click here.

For any further information on the product, please contact the branch managers of localECGC Offices .

Title: SEC FAQ

SME FAQ ?

Who can avail cover under this policy ?

Who can avail cover under this policy ?

Exporters engaged in manufacturing activities having invested in plant and machinery or engaged in export of services having invested in equipment as per MSMED Act, 2006 , can avail cover under the policy . The exporter has to submit MSME certificate issued by designated authority.

Title: SME FAQ ?

What will be duration of policy and percentage of cover ?

What will be duration of policy and percentage of cover ?

One year and 90%

Title: SME FAQ ?

What is maximum Liability under this policy ?

What is maximum Liability under this policy ?

The maximum liability under the policy is Rs.10,00,000/-.

Title: SME FAQ ?

What is the extent of cover available on the individual buyer/bank under policy?

What is the extent of cover available on the individual buyer/bank under policy?

An individual buyer will have cover up to single loss limit Rs. 3.00 lacs . No cover is available for buyers placed under buyers specific approval list (BSAL maintained by the Corporation. The exporters are required the buyer’s position regarding same by accessing the website of the Corporation.

Title: SME FAQ ?

What is the premium payable under this policy?

What is the premium payable under this policy?

Rs.5000/-

Title: SME FAQ ?

Will the cover be available for buyers in all countries ?

Will the cover be available for buyers in all countries ?

The cover under the policies would be available for exports made to the buyers or against L/cs opened by banks in Open cover countries as per Country category list of the Corporation . The exports to the countries in the Restricted Categories List of the Corporation are not cover under this policy. Before making shipment information on country category should be obtained by accessing website of the Corporation.

Title: SME FAQ ?

When the premium for the policy will be paid ?

When the premium for the policy will be paid ?

The premium under policy is payable fully in advance. However, there is a facility for paying the premium in four quarterly installments. It is to be ensured that each quarterly Premium installment is remitted on or before 15th of the beginning of the quarter (applicable if installment facility is opted for).

Title: SME FAQ ?

What steps are to be taken when an export bill becomes overdue ?

What steps are to be taken when an export bill becomes overdue ?

a. A declaration is to be submitted on or before 15th of every month regarding all bills which remained unpaid for more than 30 days from due date as at the end of previous month .

b. Reason for non acceptance / non payment should be ascertained. . The safe custody of the goods in a bonded warehouse should be arranged in the event of non acceptance of goods by the buyer.

c. If the terms of payment is DA/OD and nonpayment is due to insolvency of the buyer, a claim should be lodged with the Official Receiver to rank against the insolvent’s estate.

d. The unpaid bill should be noted and protested by a notary public in the buyer’s country for non acceptance / nonpayment by the buyer with the assistance of your bank.

e. Prompt and effective steps for recovery of the debt should be taken. Names of the debt recovery agencies, Indian Embassies and Solicitors can be obtained from ECGC.

f. All other practicable steps to minimize including resale to an alternate buyer or reshipment back to India in respect of goods unaccepted by the buyer, as per advice of the Corporation.

Title: SME FAQ

When the claim will be payable under this policy?

When the claim will be payable under this policy?

The exporter will be eligible for payment of claim after the waiting period which 2 months from the due date or extended due date of payment of export bills.

Title: SME FAQ ?

What is the time limit for filing the claim?

What is the time limit for filing the claim?

File the claim on the prescribed form with all enclosures listed therein within 12 months from the due date of the unpaid bill.

For any further clarification,click here.

For any further information on the product, please contact the branch managers of localECGC Offices .

Title: SME FAQ ?

Software Project Policy FAQ ?

What are the salient features of Software Projects Policy?

What are the salient features of Software Projects Policy?

Considering that software projects have special characteristics, the following features have been introduced in the Software Project Policy:

Title: Software Project Policy FAQ

What are the risks covered under the Software Projects Policy?

What are the risks covered under the Software Projects Policy?

Commercial risks:

Political risks:

The losses due to the risks described under (e) above would be covered by the Corporation subject to a maximum of 25% of the value of export.

Title: Software Project Policy FAQ

What are the other features of the Software Projects Policy?

What are the other features of the Software Projects Policy?

Premium in respect of contracts not exceeding one year will be charged at the same rates applicable for Buyer Exposure policies. For periods exceeding one year, the premium would be loaded by adding premium proportionately for period beyond one year. Other conditions will be as applicable for Buyer Exposure policies, except for the treatment of overdue situations, ascertainment of loss and documents required to be submitted with the claim. The requirements would be decided on a case-to-case basis, as the terms of contract will vary widely. However, the basic principles governing these requirements would be the minimization of loss while dealing with overdue and establishment of loss while deciding on the documents to be submitted for claim. The requirements would be specified while issuing the Policy. The policy will be offered for contracts, which contain standard terms conditions as per the norms and practices of the software export industry.

Title: Software Project Policy FAQ

Under which policy supply of software products and packages (ready made/standard software developed and supplied in floppies/discs or through electronic media) will be covered?

Under which policy supply of software products and packages (ready made/standard software developed and supplied in floppies/discs or through electronic media) will be covered?

For any further clarification,click here.

For any further information on the product, please contact the branch managers of localECGC Offices .

Title: Software Project Policy FAQ

SSP FAQ ?

What are the different risks covered under SSP (ST)?

What are the different risks covered under SSP (ST)?

Commercial risks:

[For SSP-ST policies of the type Specific Shipments commercial and political risks]

Political risks:

Insolvency default of LC opening bank

[For SSP-ST policies of the type Specific Shipments commercial and political risks]

Title: SSP FAQ

What are the risks not covered under SSP (ST)?

What are the risks not covered under SSP (ST)?

Some of the important features of the IT enabled services contracts are as follows:

Title: SSP FAQ

What is the procedure to be followed to obtain SSP (ST)?

What is the procedure to be followed to obtain SSP (ST)?

The exporter has to submit a proposal in the prescribed form along with a copy of the L/C or relevant contract. Different proposal forms are to be used for different types of SSP-ST policies. Normally, the proposal has to be submitted before making the shipment and the cover would be given only from the date of receipt of proposal.

Title: SSP FAQ Which all shipments can be covered under SSP (ST)?

Which all shipments can be covered under SSP (ST)?

The exporter can opt to cover one or more shipments under a particular contract. He can also choose to cover shipments made during a given period within the validity of the contract. For example if an exporter has received a contract for supply of goods within a period of say, one year, he can choose to cover a batch of shipments to be made within a period, say 90 days or 180 days. He may opt to cover further shipments under another specific policy at a later date.

Title: SSP FAQ What is the period of validity of SSP (ST)?

What is the period of validity of SSP (ST)?